JPMorgan to Pay $11B Settlement (Reports): Is Bank a Scapegoat or a Scoundrel?

Updated from 12:15 p.m. ET

Update: JPMorgan is in talks with regulators to pay $11 billion to settle a variety of regulatory investigations into alleged wrongdoing. The tally includes $7 billion in cash and $4 billion in relief that J.P. Morgan provide directly to consumers, The WSJ reports. JPMorgan shares were recently up 2.6% on the reports as investors hope the settlement will remove the risk of additional litigation but talks remain fluid and the final tally of any settlement remains to be determined.

Earlier: Less than a week after paying $920 million to settle allegations of wrongdoing in the infamous “London Whale” trade, JPMorgan (JPM) has offered to pay $3 billion to settle a variety of criminal and civil charges, The WSJ reports.

The settlement would address a variety of federal and state probes into JPMorgan’s role in the packaging and sale of mortgage-backed-securities during the housing boom and its aftermath. Much of the alleged wrongdoing occurred at Bear Stearns and Washington Mutual, two firms JPMorgan scooped up during the 2008 crisis.

There are essentially two schools of thought about the ongoing investigations into JPMorgan and the bank’s attempts to settle:

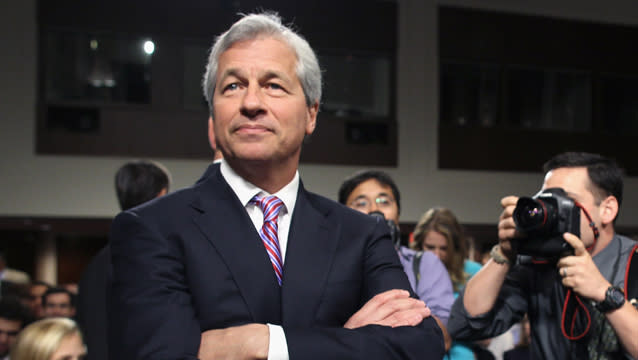

One, the government is trying to send a message to the public – and Wall Street – that it will vigorously pursue corporate malfeasance and white collar crimes. Since JPMorgan is the nation’s biggest bank – and CEO Jamie Dimon has criticized the Obama administration – the firm makes a juicy target for government prosecutors.

In the accompanying video, Henry Blodget and Michael Santoli effectively represent this view.

“It’s just a huge pile on of JPMorgan because everyone is angry they came through the financial crisis and looked good,” Henry said, noting the London Whale trade was merely a trade that went bad, costing the bank over $6 billion. “It really was a ‘tempest in a teapot’ and we’re making it out like the biggest crime in the world,” he says.

Further in support of this “JPMorgan as scapegoat” thesis, Mike Santoli observes the $3 billion settlement being discussed is a somewhat arbitrary number.

“It’s an absurdist thing,” Santoli says. “Because JPMorgan is so big, the economic penalty has to be proportionate. How does that make sense if the punishment should fit the alleged crime?”

Related: Jamie Dimon: Still ‘Last Man Standing’ But Knocked Down a Few Pegs

Two, JPMorgan has a long-running track record of questionable practices and has brought this regulatory attention on itself. Furthermore, given JPMorgan’s massive scale, the firm has shown that “crime pays” because it is able to absorb these legal hits and maintain big profits.

Effectively or not, this is the argument I try to make in the accompanying video.

As of this writing, JPMorgan has spent about $19 billion on litigation and related expenses, but has not had a single quarterly loss in the past five years and routinely generates well above $20 billion in revenue every 90 days. The firm currently operates under four regulatory enforcement actions – the most of any major U.S. bank – and faces at least seven separate Justice Department investigations for alleged misdeeds during the housing boom and resulting bust.

In further support of this view, I present the following, from a March 2013 report entitled Out of Control by Graham Fisher analyst Josh Rosner:

“JPMorgan’s list of regulatory violations over the past five years is long, diverse and crosses legal and regulatory jurisdictions,” including violations of the Global Terrorism Sanctions Regulations, Iranian Transactions Regulations, Weapons of Mass Destruction Proliferators Sanctions Regulations, and Executive Order 13382, i.e. ‘Blocking Property of Weapons of Mass Destruction Proliferators and Their Supporters.’

“Many of these infractions are for repeated violations of specific control failures, which the Company had previously agreed to remedy,” Rosner notes.

Related: Taken to Task: Jamie Dimon’s House of Ill Repute

Back in 2010, I took Jamie Dimon to task for "creating a culture where bad behavior seems to be epidemic across the bank" and little seems to have changed in the ensuing years, despite rhetoric to the contrary.

That said, the bank and its employees are innocent until proven guilty. If JPMorgan really has nothing to hide, better for them to fight the government then give in to what its defenders see as a form of extortion. Personally, I'd like to see the truth come to light and have all these allegations discussed in an open trial. But it seems much more likely JPMorgan will settle in the hopes of moving on and getting back to business -- where it has an incentive to keep pushing the envelope because the rewards of bad behavior outweigh the risks.

Aaron Task is the host of The Daily Ticker and Editor-in-Chief of Yahoo! Finance. You can follow him on Twitter at @aarontask or email him at altask@yahoo.com